You will only see the unapplied cash payment income account on cash basis, not on accrual basis.

We’ll go over unapplied cash payment income and unapplied bill payment expense on the profit and loss report: 1) An example of unapplied cash payment income on the Profit and Loss report:

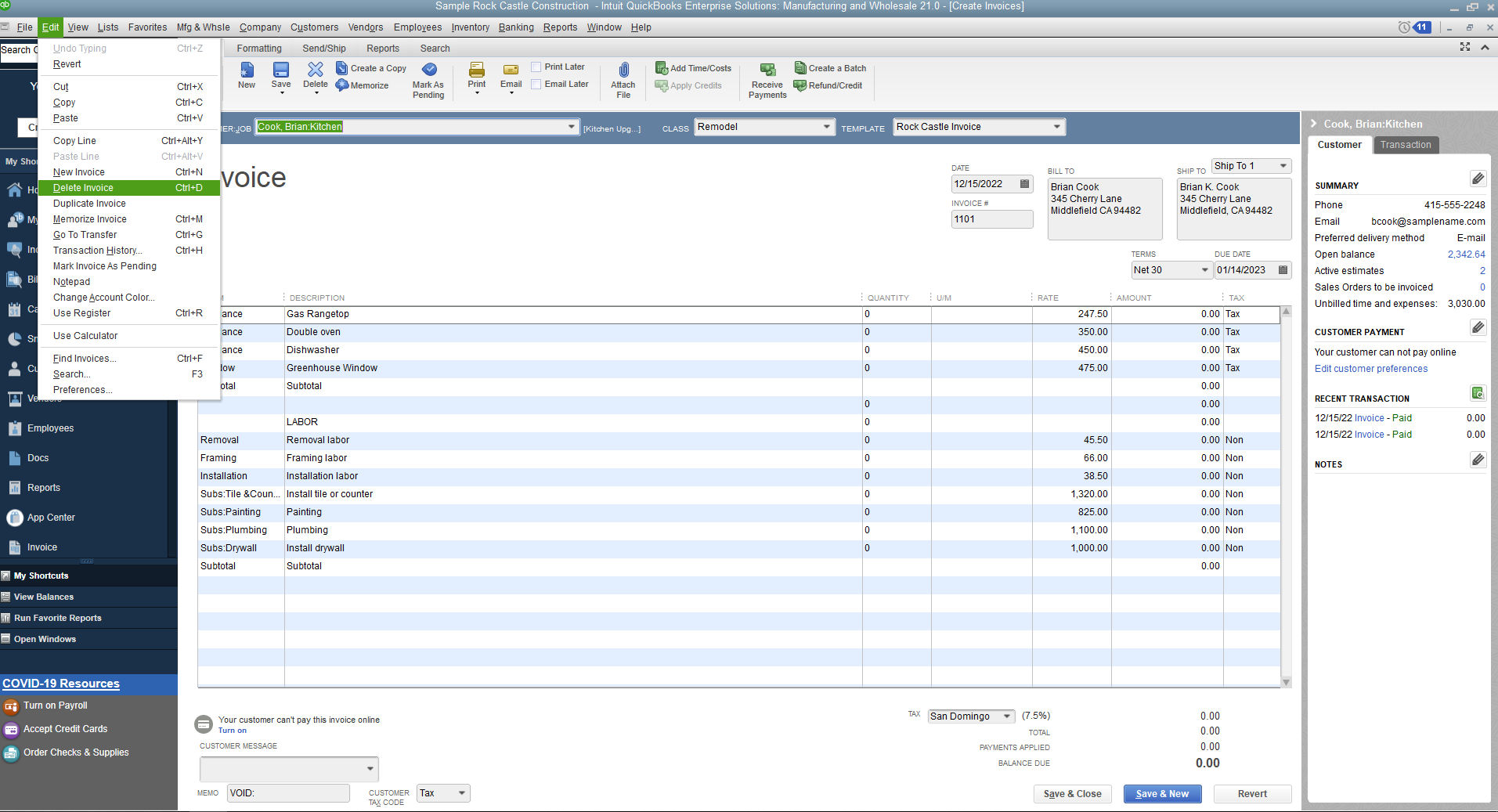

How to delete payment received in quickbooks how to#

So do you want to see how to do it yourself? Click on the links below to see step-by-step examples in my video. How to clean up Unapplied Cash Payment Income and Expense accounts in QuickBooks Online Once again, if any journal entries were used to adjust accounts payable in a QuickBooks desktop to QuickBooks Online conversion, those balances tend to be put in the unapplied bill payment expense account as well. It can also happen when a bill payment and a vendor bill are not applied to each other. The primary way this happens is when the date of a bill payment is before the date of the vendor bill. What about unapplied bill payment expense? How does a balance appear there? What causes a balance in the Unapplied Bill Payment Expense account? Make sure the product or service is mapped to an income account type to prevent this from happening. This will cause the amount to go into unapplied cash payment income without actual payment being received.

The product or service item on the invoice may be mapped to a bank account type. If journal entries were used to adjust accounts receivable in QuickBooks desktop, this may be a cause.Īccording to the QuickBooks support website, there is another possible (yet uncommon) cause.

You may also see unapplied cash payment income when a QuickBooks desktop to QuickBooks Online conversion has been made. It may also happen when a customer payment and an invoice are not applied to each other. When that happens, it will cause an amount to be added to the unapplied cash payment income account by QuickBooks. Generally, this account appears when the date of a customer payment is before the date of the invoice. How does a balance get there? What are the causes? Let’s start with a look at the unapplied cash payment income account in QuickBooks Online. What causes a balance in the Unapplied Cash Payment Income account? Journal entries can create an even bigger mess! Journal entries affect both cash and accrual basis, but the unapplied cash payment income and expense accounts are only cash basis accounts.

0 kommentar(er)

0 kommentar(er)